Best Health Insurance Plans 2024

Navigating the world of health insurance can be daunting, especially with the myriad of plans available in 2024. As healthcare costs continue to rise, having the right health insurance plan is not just a luxury; it’s a necessity. This review will delve into the best health insurance plans for 2024, exploring their features, specialties, uses, and the pros and cons of each option. By the end of this review, you will have a comprehensive understanding of the available health insurance plans, allowing you to make an informed decision about your healthcare coverage.

Features of Best Health Insurance Plans 2024

The best health insurance plans in 2024 come with a variety of features designed to meet the diverse needs of consumers. Here are some key features that distinguish the top plans this year:

1. Comprehensive Coverage Options

The leading plans offer a wide range of coverage options, including:

- Inpatient Hospitalization: Covers the costs of overnight stays in hospitals.

- Outpatient Services: Includes visits to doctors or specialists that don’t require hospitalization.

- Preventive Care: Many plans now offer free preventive services, such as vaccinations and screenings.

2. Affordable Premiums and Deductibles

While premiums are essential to consider, deductibles are equally critical. The best plans in 2024 balance affordable monthly premiums with reasonable deductibles, making it easier for individuals and families to manage their healthcare expenses.

3. Extensive Network of Providers

Access to a broad network of healthcare providers ensures that members have a choice of doctors, specialists, and facilities. Many top plans have partnerships with various healthcare systems, providing better access to quality care.

4. Prescription Drug Coverage

As medications can significantly impact healthcare costs, the best health insurance plans in 2024 include comprehensive prescription drug coverage, often at reduced copays for essential medications.

5. Telehealth Services

With the rise of telemedicine, many plans now include telehealth services as part of their offerings. This allows members to consult healthcare professionals remotely, which is especially convenient for minor ailments or follow-up consultations.

Specialty of Best Health Insurance Plans 2024

In addition to standard features, the best health insurance plans for 2024 have unique specialties that cater to specific needs. Here are a few standout specialties:

1. Family-Centric Plans

Several plans focus on family needs, offering benefits such as pediatric care, maternal health services, and child wellness programs. These plans often feature lower deductibles for children’s services and include extensive coverage for preventive care.

2. Specialized Care Options

Certain health insurance providers offer specialized care plans targeting chronic conditions such as diabetes, heart disease, or mental health. These plans often include additional support services, including access to nutritionists, specialists, and mental health counselors.

3. Wellness Programs

Many top health insurance plans now integrate wellness programs into their offerings. These programs encourage healthy living through incentives for regular exercise, annual health assessments, and preventive screenings.

4. Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

The best plans often include options for FSAs or HSAs, allowing members to save money tax-free for medical expenses. These accounts can help manage out-of-pocket costs more effectively.

Uses of Best Health Insurance Plans 2024

Understanding the practical applications of health insurance can help individuals and families utilize their plans effectively. Here are some common uses of the best health insurance plans in 2024:

1. Routine Healthcare Services

The best plans cover routine healthcare services, such as annual check-ups, vaccinations, and screenings, which are essential for maintaining overall health.

2. Emergency Services

In cases of medical emergencies, having a solid health insurance plan can significantly reduce out-of-pocket expenses associated with emergency room visits and ambulance services.

3. Chronic Condition Management

For individuals with chronic conditions, having health insurance that covers regular visits to specialists and necessary medications is crucial. The best plans offer comprehensive coverage for ongoing treatment.

4. Preventive Services

Many plans now emphasize preventive care, which can help identify health issues before they become serious. Services like mammograms, colonoscopies, and annual physicals are often covered at no cost.

5. Mental Health Support

Access to mental health services is increasingly recognized as vital. The best health insurance plans of 2024 include robust mental health support, covering therapy sessions and psychiatric consultations.

Main Theme of Best Health Insurance Plans 2024

The overarching theme of health insurance in 2024 is accessibility and affordability. As healthcare costs continue to climb, insurance providers are under pressure to create plans that not only provide essential coverage but also make healthcare accessible to a broader audience. This has led to several important trends:

1. Greater Emphasis on Preventive Care

Insurance providers are prioritizing preventive care, which can ultimately lead to lower healthcare costs by preventing serious health issues. Plans that focus on preventive services help consumers maintain better health over time.

2. Technological Integration

Telehealth services and online health management tools are becoming standard. Plans that incorporate technology allow members to access healthcare conveniently and efficiently.

3. Customizable Plans

Flexibility is key in 2024, with many providers offering customizable plans that allow individuals to tailor coverage based on their specific needs and financial situations.

4. Increased Transparency

Health insurance companies are moving toward greater transparency in their offerings. Clear information regarding coverage details, costs, and provider networks helps consumers make informed decisions.

Pros and Cons of Best Health Insurance Plans 2024

| Pros | Cons |

|---|---|

| Comprehensive coverage options | Premiums can be high for extensive plans |

| Access to a wide network of providers | Some plans have restrictive networks |

| Preventive care covered at no cost | Higher deductibles for certain services |

| Telehealth services for convenience | Not all services covered (e.g., cosmetic) |

| Wellness programs encourage healthy living | Complexity in understanding plan details |

Conclusion: Best Health Insurance Plans 2024

Choosing the best health insurance plan in 2024 requires careful consideration of your personal needs, preferences, and financial situation. The landscape of health insurance is evolving, focusing on affordability, accessibility, and comprehensive coverage. Whether you are looking for family-centric plans, specialized care, or plans that emphasize preventive services, 2024 has a range of options to fit various needs.

In conclusion, take the time to compare different health insurance plans available in 2024. Evaluate the features, specialties, and costs associated with each option. By doing so, you will ensure that you select a plan that provides the best coverage for you and your family’s health needs, ultimately leading to better healthcare outcomes and financial peace of mind.

FAQs: Best Health Insurance Plans 2024

- What are the most affordable health insurance plans in 2024?

- The most affordable plans typically include basic coverage options with lower premiums and higher deductibles. It’s essential to compare plans based on your specific needs.

- How do I choose the right health insurance plan for my family?

- Consider factors such as coverage options, network of providers, premium costs, and specific family health needs when selecting a plan.

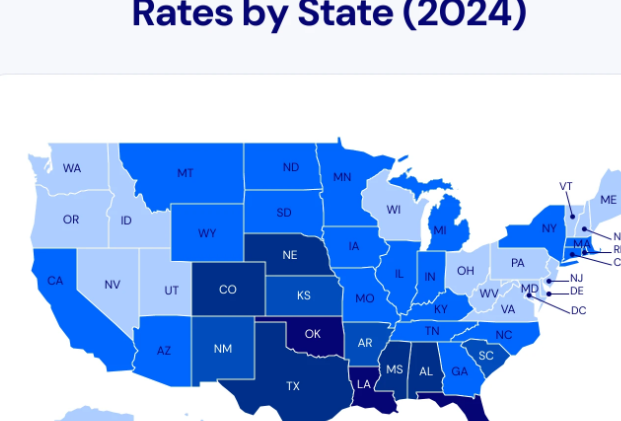

- What factors affect my health insurance premium?

- Premiums are influenced by factors such as age, location, type of coverage, and the insurance provider’s pricing strategies.

- Are there any new features in health insurance plans for 2024?

- Yes, many plans have introduced enhanced telehealth services, wellness programs, and customizable coverage options to better meet consumer needs.

- How can I switch my health insurance provider?

- To switch providers, you will need to compare plans, enroll in a new policy during the open enrollment period, and ensure that you don’t have a gap in coverage.

This comprehensive review provides a detailed overview of the best health insurance plans in 2024, enabling consumers to make informed decisions regarding their healthcare coverage.